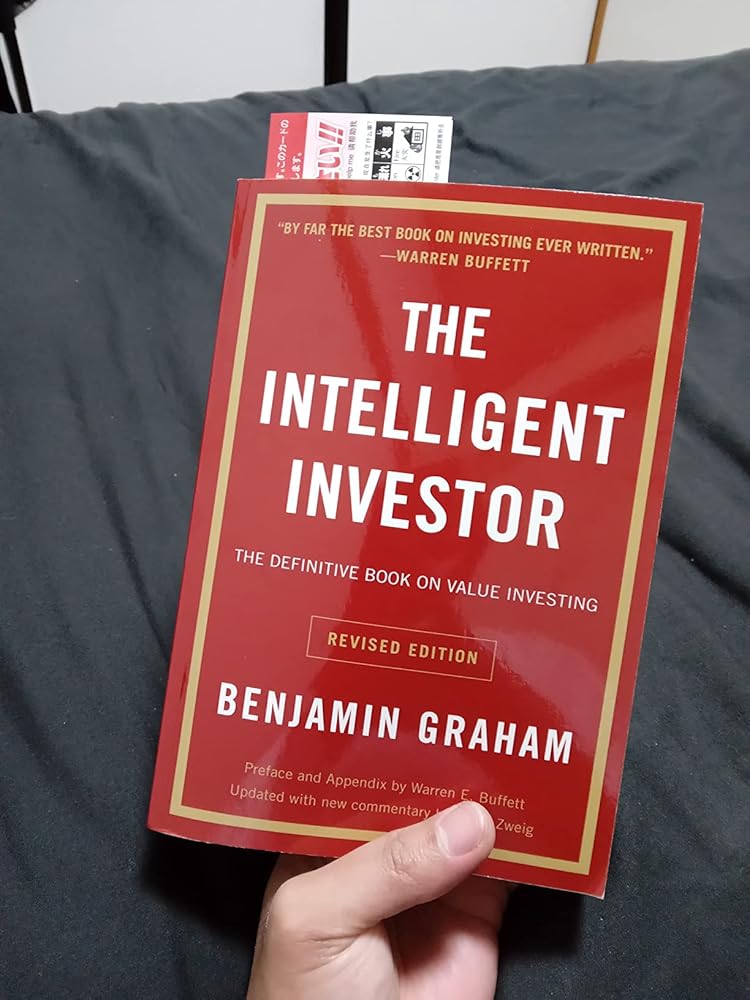

Let me start by saying this book is a heavyweight in the investment world for a reason. I've read it cover to cover twice, and each time I've walked away with new insights. The core principles Graham lays out are as relevant today as they were when first published.

What really stands out is Graham's distinction between investing and speculation. In today's meme stock and crypto-crazy world, this lesson is more important than ever. His 'Mr. Market' analogy perfectly captures the irrational behavior we see in markets daily.

The practical advice in chapters 8 (managing emotions) and 20 (margin of safety) alone are worth the price of the book. I've applied these concepts to my own portfolio and they've saved me from making emotional decisions during market downturns.

That said, some sections feel dated - like the emphasis on dividend-paying stocks or physical stock certificates. You'll need to mentally translate some concepts to today's digital investing landscape. The commentary by Jason Zweig helps with this, though I don't always agree with his interpretations.

The physical book quality could be better - my copy arrived with some printing errors and missing words. But the content is so valuable that I'd recommend buying it despite these minor issues.

Warren Buffett's included essay 'The Superinvestors of Graham and Doddsville' is the cherry on top - a brilliant takedown of efficient market theory that every investor should read.

This isn't a get-rich-quick guide. It's a masterclass in disciplined, long-term investing. If you're serious about building wealth in the markets, this book deserves a permanent spot on your shelf.