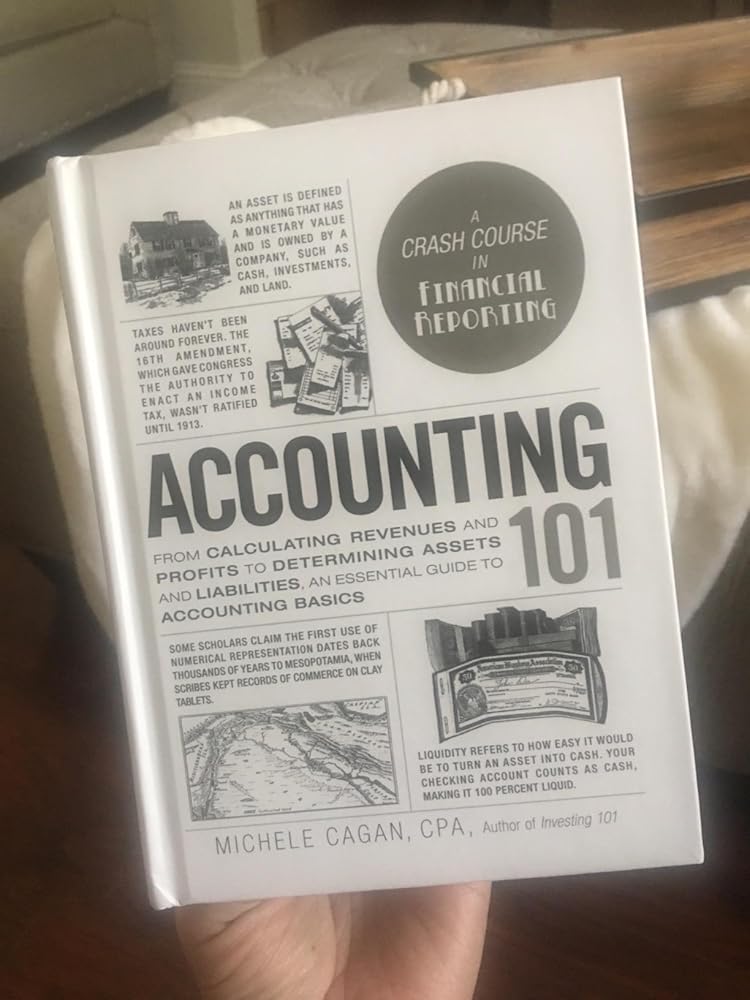

If you're like me and the word 'accounting' used to send shivers down your spine, this book is a game-changer. 'Accounting 101' breaks down complex concepts into bite-sized, easy-to-digest pieces. I remember flipping through the first chapter on revenues and profits, and actually feeling excited to learn more—something I never thought I'd say about accounting!

The author’s writing style is engaging, almost like having a patient tutor by your side. Little historical tidbits and real-world examples (like how ancient merchants kept track of trades) made dry topics unexpectedly fascinating. Pro tip: Pair this with her website resources—she replies to emails faster than my accountant during tax season!

Now, let’s talk practicality. As someone who runs a small Etsy shop, I used to blindly hand over receipts to my CPA. After reading the assets/liabilities section, I finally understood why my ‘vintage teacup inventory’ isn’t just clutter—it’s a balance sheet item! The book won’t replace your CPA (my attempt at DIY tax filing proved that), but you’ll stop nodding blankly in meetings.

One gripe? I wish there were more hands-on exercises. While it brilliantly explains debits/credits, I craved practice templates for creating actual financial statements. Maybe a sequel? *hint hint*

Verdict: Whether you're a grad student (shoutout to the reviewer who prepped with this!), a curious entrepreneur, or just adulting hard with personal finances—this $15 book delivers more value than my $200/hour accounting consultant. Well… almost.